Crypto Market in the last 24h

📊 Global crypto market cap: 2.98T USD (−1.07% ↓)

💸 Total 24h volume: 113.06B USD (−0.49% ↓)

🔗 DeFi volume: 14.76B USD | 13.05% of total (↑ share)

🪙 Stablecoins volume: 112.43B USD | 99.44% of total (↑ dominance)

₿ Bitcoin dominance: 58.96% (+0.04% ↑)

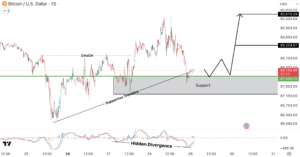

Bitcoin (BTC) analysis

BTCUSD is holding a key support zone around 87,900 – 88,000 USD (approx. 80,868 – 80,960 EUR), aligned with a rising supportive trendline on the medium timeframe. This confirms that buyers remain active in this area.

The presence of hidden bullish divergence points to continuation strength rather than a reversal scenario. As long as this support holds, price may consolidate and then push higher toward the first resistance at 89,250 USD (approx. 82,110 EUR), followed by upside targets near 90,600 USD (approx. 83,352 EUR).

Ethereum (ETH) analysis

ETHUSD is holding a strong medium-timeframe support between 2,940.00 – 2,955.00 USD (approx. 2,705 – 2,719 EUR), where a clear W pattern is forming alongside bullish divergence. This suggests buyer absorption after the recent sell-off.

The zone around 2,963 USD (approx. 2,726 EUR) now acts as immediate resistance. A successful reclaim could open upside toward 2,983 USD (approx. 2,744 EUR) and then the major target at 3,000 – 3,005 USD (approx. 2,760 – 2,765 EUR).

As long as price remains above the support block, the structure favors bullish continuation rather than further downside.

MultiversX (EGLD) analysis

EGLDUSD is reacting from a key medium-timeframe support around 5.55 – 5.57 USD (approx. 5.11 – 5.12 EUR), where price is holding despite previous weakness.

The broader structure shows a falling wedge, while bullish divergence indicates that selling pressure is fading. A sustained hold above support could trigger a recovery toward the first resistance at 5.69 USD (approx. 5.23 EUR), followed by the higher target near 5.91 USD (approx. 5.44 EUR).

Failure to hold the support zone would weaken the bullish setup and delay any upside continuation.

Binance Coin (BNB) analysis

BNBUSD is trading near a key medium-timeframe resistance zone between 903 – 909 USD (approx. 831 – 836 EUR), where price is currently consolidating after a strong recovery.

The structure shows a W pattern, supported by bullish divergence, signaling strengthening momentum. A clean acceptance above 909 USD (approx. 836 EUR) could open upside targets toward 932USD (approx. 857 EUR) and then 960 USD (approx. 883 EUR).

Kusama (KSM) analysis

KSMUSD is forming an inverse head and shoulders structure on the medium timeframe, with the right shoulder developing around 6.60 – 6.65 USD (approx. 6.07 – 6.12 EUR).

Neckline resistance sits at 6.90 – 6.95 USD (approx. 6.35 – 6.39 EUR). A decisive breakout above this zone can confirm a bullish reversal. With bullish divergence supporting momentum, upside targets are placed near 7.20 USD (approx. 6.62 EUR) followed by 7.45 USD (approx. 6.85 EUR).

Holding above 6.50 USD (approx. 5.98 EUR) keeps the bullish bias intact.

Estimation (96H outlook)

-

BTCUSD: 96H | +1% to +2% | UP | Bullish CHoCH

-

ETHUSD: 96H | +1% to +3% | UP | At support

-

BNBUSD: 96H | +2% to +4% | UP | At support

-

DOTUSD: 96H | +2% to +4% | DOWN | Bear Flag

-

XRPUSD: 96H | +2% to +4% | DOWN | Bearish CHoCH

All cryptocurrencies are available for trading on Tradesilvania , and their prices can be seen on the Tradesilvania price page, accessible through the following link: https://tradesilvania.com/en/prices

With the help of our platform, you can deposit, withdraw, buy or sell any of these cryptocurrencies using the free digital wallet. SEPA Top-up (On-Ramp & Off-Ramp) Euro and RON instant transfers and over 150 cryptocurrencies, are all available in our app.

Limitation of Liability

This report issued by Tradesilvania is purely informative and is not intended to be used as a tool for making investment decisions in crypto-assets. Any person who chooses to use this report in the process of making investment decisions assumes all related risks. Tradesilvania SRL has no legal or other obligation towards the person in question that would derive from the publication of this report publicly.

The content provided on the Tradesilvania website is for informational purposes only and should not be considered as investment advice, financial advice, trading advice, or any other form of advice. We do not endorse or recommend the buying, selling, or holding of any cryptocurrency. It is important that you conduct your own research and consult with a financial advisor before making any investment decisions. We cannot be held responsible for any investment choices made based on the information presented on our website.

The information in this report was obtained from public sources and is considered relevant and reliable within the limits of publicly available data. However, the value of the digital assets referred to in this report fluctuates over time, and past performance does not indicate future growth.