Crypto market in the last 24 hours

🌍 Global crypto market cap: 2.3T USD (+1.72% ↑)

📊 Total 24h volume: 102.28B USD (−0.78% ↓)

🔗 DeFi volume: 11.46B USD | 11.20% of total (—)

🪙 Stablecoin volume: 103.45B USD | 101.14% of total (—)

₿ Bitcoin dominance: 58.39% (−0.01% ↓)

Bitcoin (BTC) analysis

BTCUSD on the 15-minute timeframe is compressing inside a rising wedge, with price sitting directly above the marked support near 66,300 USD (56,100 EUR). A rising wedge after a short-term bounce typically signals buyer exhaustion, and repeated rejections from the upper trendline indicate weakening momentum. If Bitcoin breaks down and closes below this support, it could trigger a fast liquidity move toward 64,600 USD (54,600 EUR), and if selling pressure continues the next downside level sits around 63,000 USD (53,300 EUR). Until support is lost, price may keep ranging inside the wedge, but structure currently favors a bearish move rather than an upside breakout.

Ethereum (ETH) analysis

ETHUSD on the 15-minute timeframe is moving upward inside a rising wedge while forming a bear flag after a sharp drop, which usually represents a temporary relief bounce rather than a real trend reversal. The market is holding just above support near 1,928 USD (1,630 EUR), but momentum is fading as candles keep rejecting near the upper trendline around 1,975–1,980 USD (1,670–1,675 EUR). This structure often breaks to the downside. A confirmed close below support could trigger a quick move toward 1,895 USD (1,606 EUR), and if selling expands the next liquidity zone is near 1,860 USD (1,577 EUR). Until support breaks, ETH may consolidate inside the wedge, but overall structure still favors bearish continuation.

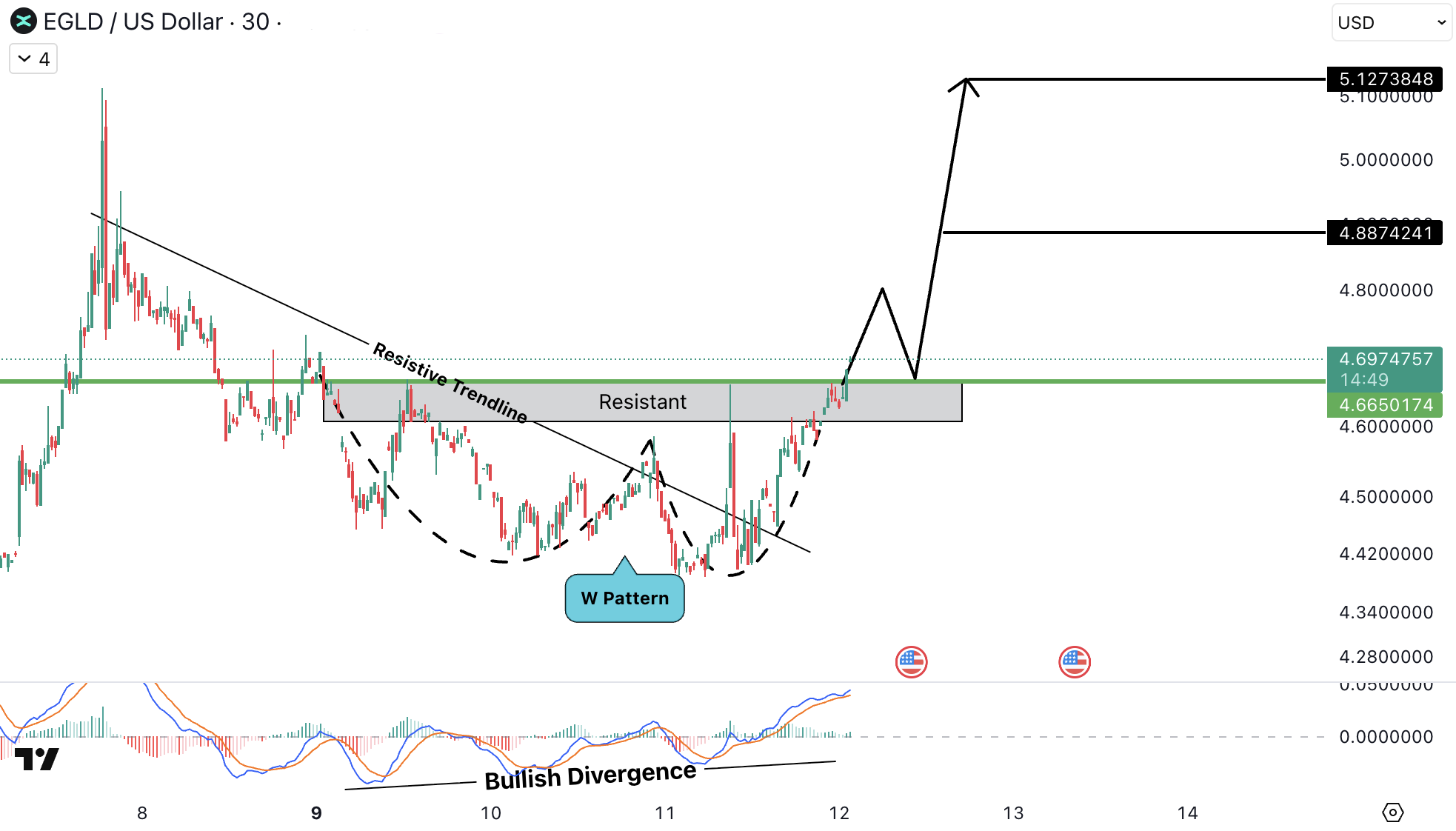

MultiversX (EGLD) analysis

EGLDUSD has broken above the descending resistance trendline and formed a clear W pattern along with bullish divergence, signaling strengthening buying momentum. Price is now testing resistance around 4.66–4.70 USD (3.94–3.97 EUR), which is the key decision zone. A successful hold and breakout above this area could push price toward 4.88 USD (4.11 EUR), followed by the next upside target near 5.12 USD (4.32 EUR). However, rejection from resistance could lead to a short pullback before continuation.

Pepe (PEPE) analysis

PEPEUSD is attempting a breakout after moving inside a descending channel, with price approaching resistance near 0.0000037–0.00000374 USD (0.00000313–0.00000316 EUR). This area is the key barrier for bullish continuation. A clean reclaim and hold above resistance could trigger upside toward 0.00000397 USD (0.00000336 EUR) and then 0.00000424 USD (0.00000359 EUR). Rejection from this zone may send price back toward the channel range before any stronger move.

Binance Coin (BNB) analysis

BNBUSD is trading inside a rising wedge and forming a bear flag near the upper trendline around 615–620 USD (520–526 EUR). The chart also shows clear bearish divergence, signaling weakening bullish momentum. The major support zone sits at 604–606 USD (511–513 EUR). A breakdown below it could push price toward 595.3 USD (503 EUR) and further toward 586.4 USD (496 EUR). As long as price remains below the upper wedge resistance, downside pressure stays dominant.

Estimation (96H Outlook)

-

BTCUSD: 1%–2% DOWN — Bearish CHoCH, liquidity available near 62,000 USD (52,400 EUR)

-

ETHUSD: 1%–3% DOWN — At resistance

-

SUIUSD: 2%–4% UP — At support (Risky)

-

ALGOUSD: 2%–4% DOWN — At resistance

-

LTCUSD: 2%–4% UP — At support

All cryptocurrencies are available for trading on Tradesilvania , and their prices can be seen on the Tradesilvania price page, accessible through the following link: https://tradesilvania.com/en/prices

With the help of our platform, you can deposit, withdraw, buy or sell any of these cryptocurrencies using the free digital wallet. SEPA Top-up (On-Ramp & Off-Ramp) Euro and RON instant transfers and over 150 cryptocurrencies, are all available in our app.

Limitation of Liability

This report issued by Tradesilvania is purely informative and is not intended to be used as a tool for making investment decisions in crypto-assets. Any person who chooses to use this report in the process of making investment decisions assumes all related risks. Tradesilvania SRL has no legal or other obligation towards the person in question that would derive from the publication of this report publicly.

The content provided on the Tradesilvania website is for informational purposes only and should not be considered as investment advice, financial advice, trading advice, or any other form of advice. We do not endorse or recommend the buying, selling, or holding of any cryptocurrency. It is important that you conduct your own research and consult with a financial advisor before making any investment decisions. We cannot be held responsible for any investment choices made based on the information presented on our website.

The information in this report was obtained from public sources and is considered relevant and reliable within the limits of publicly available data. However, the value of the digital assets referred to in this report fluctuates over time, and past performance does not indicate future growth.